5 IRA Tax Forms Every SDIRA Holder Should Know

Reading time: 8 minutes

Around tax time, many have questions on the tax forms associated with their self-directed IRA (SDIRA).

If you’ve taken distributions this year, you may be wondering how to report those to the IRS. If you’ve recently received IRA tax forms from your SDIRA custodian, you may question exactly what distinguishes Form 5498 from Form 8606.

Let’s dive into the purpose of each IRA tax document so you can have a simple, stress-free tax season.

1. IRS Form 1099-R

Generally, distributions from retirement plans (IRAs, qualified plans, section 403(b) plans, and section 457(b) plans) and insurance contracts are reported to SDIRA holders on Form 1099-R.

Your SDIRA custodian will issue this form to document any distributions from your account during the calendar year.

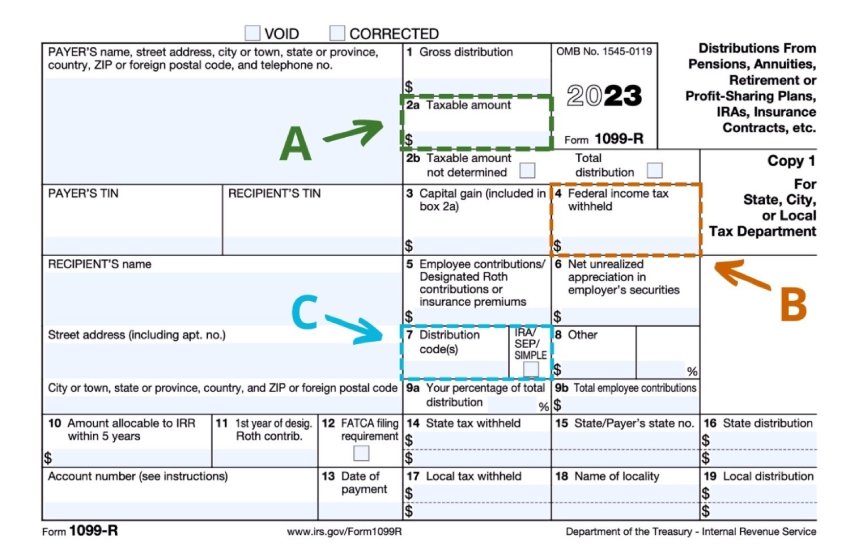

This form shows:

- The taxable amount of the distribution in Box 2a (A)

- The amount of income tax withholding in Box 4 (B)

- The IRS code that depicts the type of distribution in Box 7 (C)

What’s the deadline for IRS Form 1099-R?

SDIRA custodians must provide Form 1099-R to the account holder by January 31 after the year of distribution. For instance, Entrust will provide all SDIRA holders who receive distributions in 2024 their 1099-R by January 31, 2025.

Additional Information

If you received more than $10 in retirement plan distributions, you’ll receive a 1099-R. If an IRA holder didn’t take any distributions, no 1099-R will be issued.

A taxpayer must file this form with their income tax return only if there has been income tax withheld from the distribution (reported in Box 4).

If you roll over a distribution to another IRA, your SDIRA custodian/trustee will issue IRS Form 5498, showing the amount that was rolled over. The 5498 will offset the 1099-R.

There is no special reporting code for:

- Qualified charitable distributions (QCD)

- IRA distributions made to fund a health savings account (HSA)

- Required minimum distributions (RMDs)

Ready to learn the ropes? Dive into our SDIRA Rules Guide

2. IRS Form 5498

IRS Form 5498 is one of the primary tax documents on our radar. Unlike some of the forms on this list, Form 5498 is filed solely by an SDIRA custodian, not by the SDIRA holder.

You may receive IRS Form 5498, though this copy is only for your records. It’s not necessary to file in your tax return.

This document reports all types of contributions made to an IRA (annual contributions, rollovers, conversions, and recharacterizations). It also reflects the fair market value of an IRA as of December 31 of that year.

5498 also informs the IRS which individuals must take an RMD during the year. If the IRA holder is 73 or older, the IRS will know that an RMD is due.

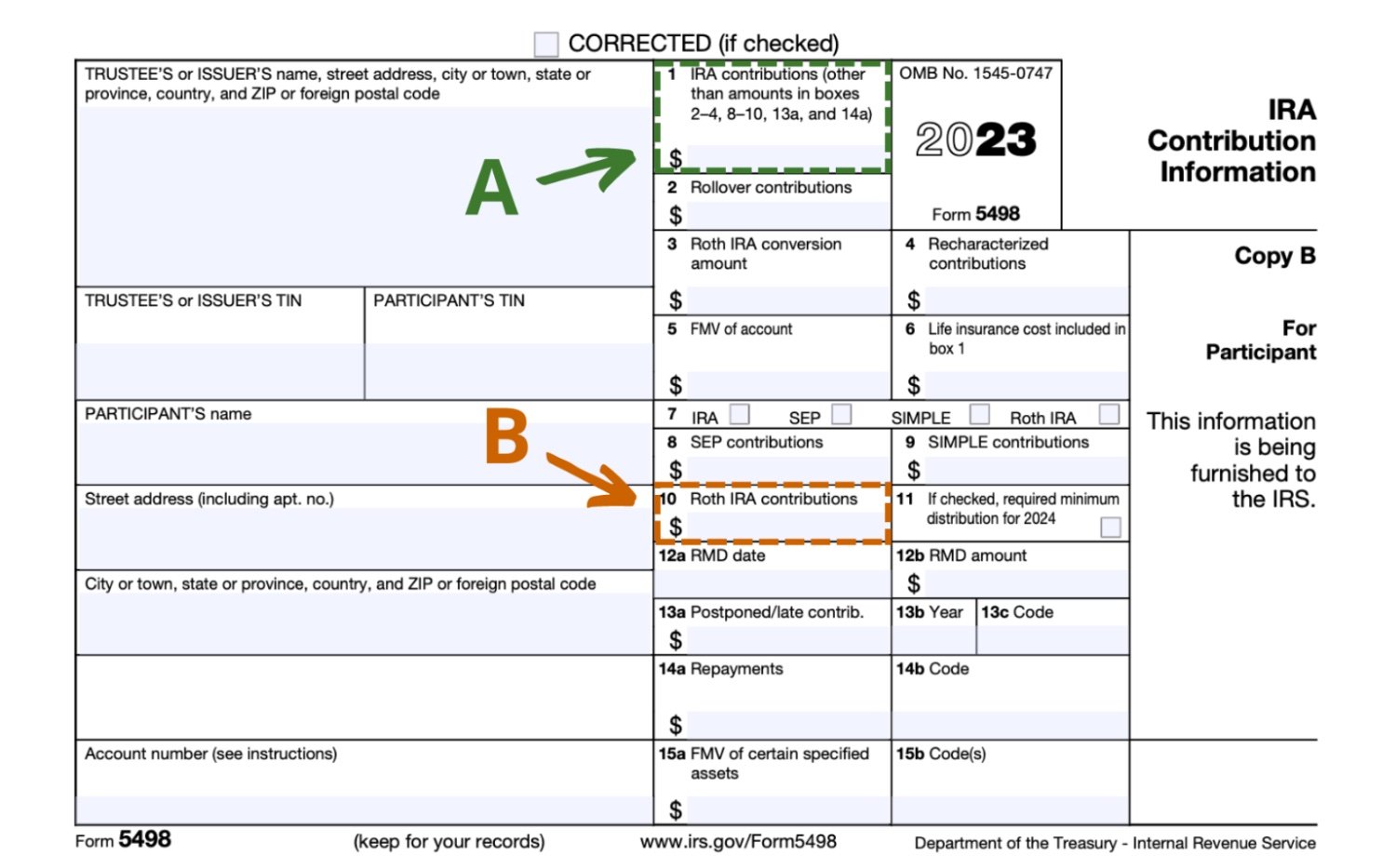

For traditional IRAs, the total value of annual contributions is reported in Box 1 of Form 5498 (A). For Roth IRAs, the amount is reported in Box 10 (B).

Note: if you or your spouse are covered under another tax-advantaged retirement plan at work, you may not be eligible to take the full contribution deduction. See a tax expert or IRS Publication 590-A to determine your eligibility.

For Roth IRAs, you cannot use your contributions as a tax deduction. These contributions are made with post-tax dollars, which is why they qualify for deferred growth and eventual tax-free distribution of earnings once you’ve met the qualified distribution criteria.

For both types of IRAs, If your adjusted gross income is below a certain level, you may be eligible for the saver’s tax credit. This may further reduce your tax liability for the year.

What’s the deadline for IRS Form 5498?

The form must be sent by the SDIRA custodian to the IRS by May 31 of the following year. For example, if you made $6,500 in contributions for 2023 to your SDIRA, your custodian must send your 5498 to the IRS by May 31, 2024.

Some SDIRA custodians may choose not to send this form if there are no new contributions to the account. Even if the IRA holder does not receive Form 5498, the IRS will still receive a copy confirming your contribution.

Additional Information

While it’s not necessary to include it in your annual tax return, Form 5498 is perhaps the most significant Roth IRA tax form.

If you hold a Roth IRA, it is important to keep a copy of this form every year you make a contribution. This provides further documentation of the total contributions that have already been taxed, helping ensure your savings are not taxed more than once.

3. IRS Form 8606

IRS Form 8606 records that some of the funds in your IRA have already been taxed. This includes non-deductible traditional IRA contributions and Roth conversions. Once you take distributions, the IRS knows not to subject those funds to any further income tax.

Be sure to check your work. If this document isn’t filled out correctly, you may end up paying federal income tax twice on the same funds.

In essence, IRS Form 8606 is used to keep track of the basis in your IRA. Basis refers to:

-

Non-deductible IRA contributions to traditional IRAs

-

After-tax rollovers made from a previous employer’s retirement plan

After-tax contributions in an employer plan are employee contributions made on an after-tax basis. These after-tax contributions are different from designated Roth contributions.

Earnings derived from Roth contributions may be withdrawn totally tax-free once you’ve met the qualified distribution criteria. Because of this unique tax advantage, only individuals below a certain income level may contribute directly to a Roth.

After-tax contributions in an employer plan, on the other hand, aren’t given tax-advantaged status. Therefore, they’re not subject to any income eligibility requirements but are subject to contribution limits. Of course, this also means any earnings from investments under this account will be taxed appropriately upon withdrawal.

Contributions to a traditional IRA may be tax deductible. If you (and your spouse) are not participating in an employer retirement plan, the contribution is fully deductible. If you or your spouse are participating in an employer plan, your income level will determine whether you’re able to deduct a traditional IRA contribution.

These limits are based on your modified adjusted gross income (MAGI). Any amount you contribute to a traditional IRA that you do not deduct on your tax return is considered a nondeductible contribution and must be tracked using IRS Form 8606.

Remember, even if you aren’t able to deduct your contribution, it may still be worth investing in a traditional IRA over a Roth IRA. This is especially true if you do not qualify to contribute to a Roth IRA because of your income level for the year.

Part II of this form tracks Roth IRA conversions. This amount will be the amount converted during the year and will be considered the basis in your Roth IRA. IRS Form 8606 is also used to track whether distributions of converted dollars from a Roth IRA are penalty-free.

You must hold funds in your Roth IRA conversions for at least five years before the funds can be distributed without penalty if you are under the age of 59 ½. Do not confuse this five-year period for tax-free distribution of earnings. This is a separate five-year clock for converted amounts to determine whether the funds are penalty-free.

If a Roth IRA holder takes a non-qualified distribution, Form 8606 designates which contributions are distributed first. The distribution ordering rules apply and may help reduce the funds that are subject to tax and the 10% early withdrawal penalty.

First to be distributed are Roth IRA contributions, which are always tax and penalty-free. Next to be distributed are conversion dollars, which are tax-free but could be subject to the 10% early distribution penalty. Finally, earnings are distributed, which are taxed like traditional IRAs if the distribution is not qualified.

What's the deadline for IRS Form 8606?

The IRA holder should file IRS Form 8606 with their tax return by the tax deadline, including extensions. However, if your tax return has already been filed, it can be filed separately.

If you fail to file IRS Form 8606 on time, you may be fined $50.

Additional Information

A separate form should be filed for each tax year that nondeductible contributions are made. Failure to file IRS Form 8606 could result in you owing income tax on amounts that should be tax-free.

4. IRS Form 990-T

You must file IRS Form 990-T if your IRA collects “unrelated business income (UBIT)” or revenue that is not related to the tax-exempt purpose of the retirement account.

This income is not tax-advantaged, so as not to create an unfair edge in taxation. Otherwise, businesses funded outside of a retirement plan might find it very difficult to compete. So, all unrelated business revenues must be reported to the IRS. If the total exceeds $1,000 in gross receipts, the IRA must file a return to report this income.

Because IRAs are considered trusts, the tax will be based on trust tax rates. Passive income such as interest, dividends, rents, and royalties are not subject to UBIT.

What’s the deadline for IRS Form 990-T?

If your IRA collected unrelated business income in the previous tax year (2023), file IRS Form 990-T by the tax deadline. In 2024, this falls on April 15.

You may file for a six-month extension using IRS Form 8868 if you need more time to prepare and submit Form 990-T.

Additional Information

A schedule M attachment must be included separately for every investment declaring unrelated business taxable income (UBIT).

The IRA holder must acquire an Employer Identification Number (EIN) for an IRA that is required to file IRS Form 990-T.

UBIT must be paid by the IRA, using IRA funds. It cannot be paid out of pocket.

5. IRS Form 1040

If you’ve paid annual income taxes, Form 1040 should be quite familiar.

The form requires taxpayers to disclose their taxable income for the year. This determines if additional taxes are owed or if the filer is due a tax refund.

Everyone who earns income over a certain threshold must file an income tax return with the IRS. If you’re wondering how income tax relates to your IRA, remember that distributions from a traditional IRA are classified as income.

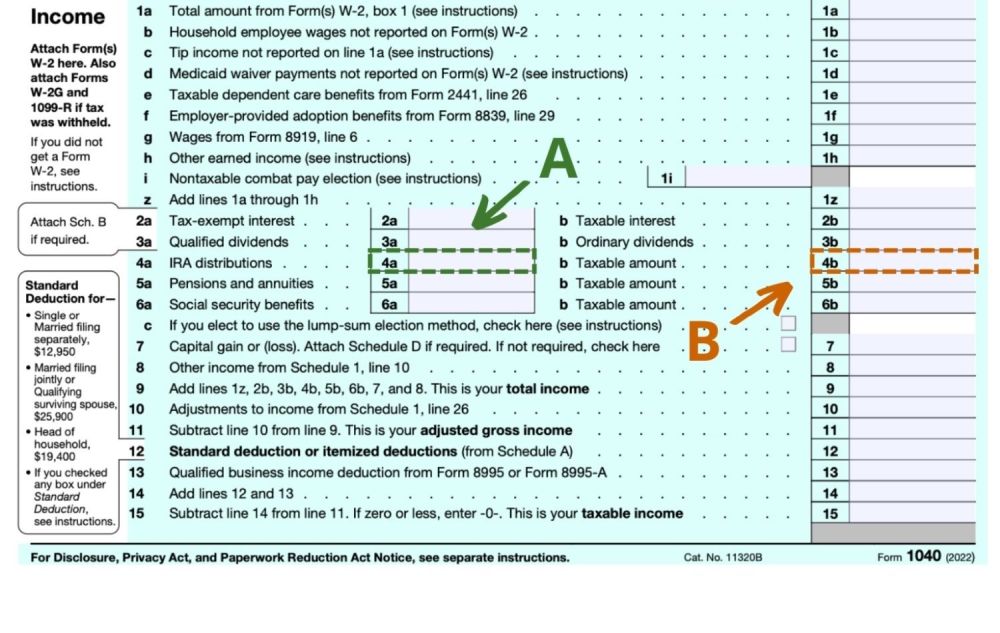

So, if an IRA holder has taken a distribution in the previous year, they must report the amount on line 4a of Form 1040 (A).

The taxable portion of the distribution is reported on line 4b of the form (B). If any amount is rolled over, the instructions state to include “rollover” beside line 4b. IRS Form 5498 should offset the 1099-R to eliminate the taxation of any amounts reported as rolling over.

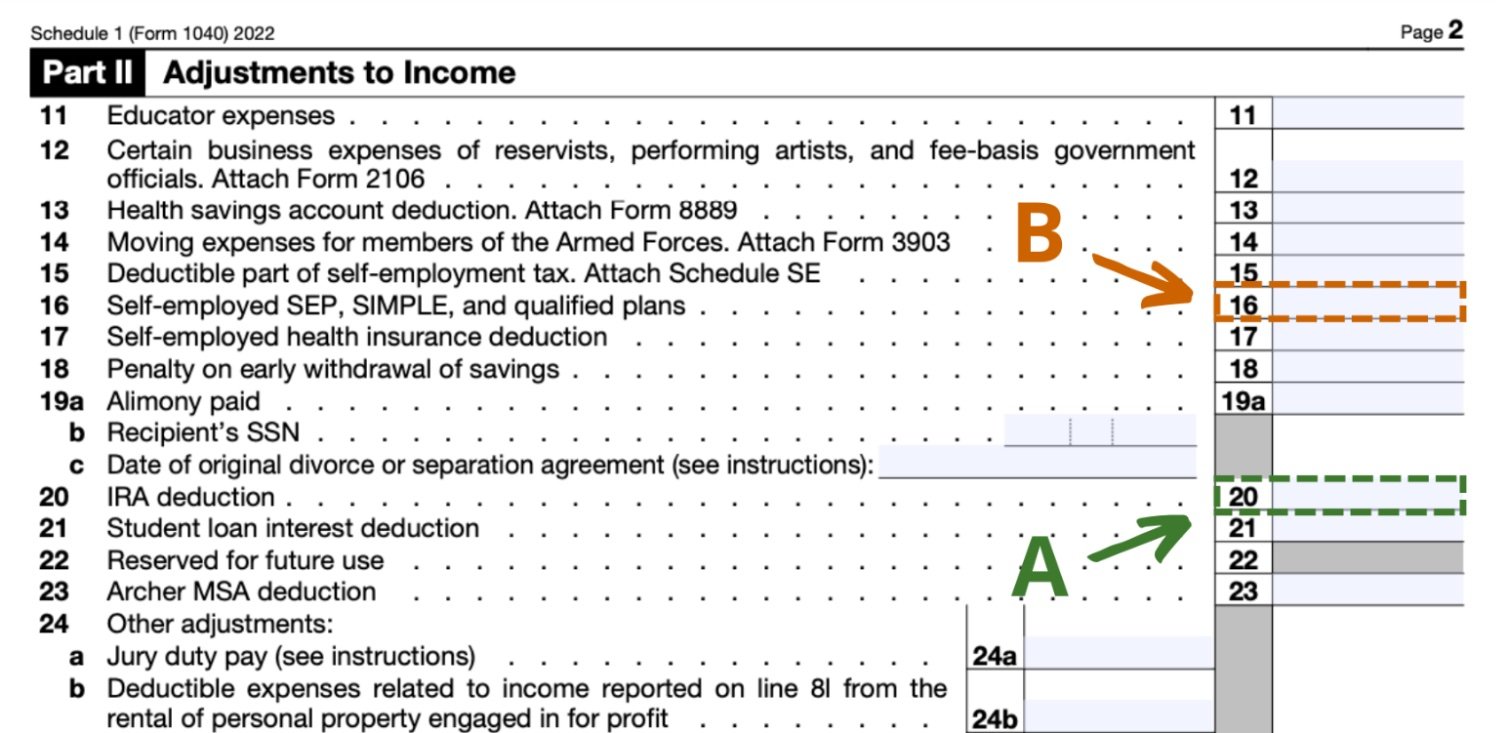

If you’ve made a deductible IRA contribution, report the amount on line 20 of the Schedule 1 attachment to Form 1040 (A). If you’ve contributed to a SEP, SIMPLE, or Qualified plan, report the amount on line 16 (B).

What’s the deadline for IRS Form 1040?

Taxpayers must file IRS Form 1040 by the tax deadline. In 2024, this falls on April 15.

Master Your IRA Tax Forms

Admittedly, tax form knowledge might not get your blood pumping as much as the prospect of a new investment opportunity.

However, understanding taxation is an integral component of managing tax-advantaged accounts. An SDIRA holder with a deep understanding of the relevant tax codes can make more informed decisions on their savings strategies.

If you’re interested in learning more about IRA taxation from a trusted professional, check out our recent webinar, 2024 IRA Essentials: Changes & Deadlines All Holders Should Know.

4 Comments